Managing the Market during and after COVID-19

Quarantine.

Schools closed.

Unemployment.

That’s all we hear about in the news these days.

All of us will look back on 2020 as the year that things got very weird. We will remember the people who perished due to this terrible virus and we celebrate the heroes, the frontline responders, nurses, doctors, EMT’s, Police and Firefighters. We’ll also remember the truck drivers and grocery store workers who put themselves in harm’s way to make sure that we were all fed and had plenty of toilet paper.

What will the new normal be like?

Socially, it will probably be different.

Schools, restaurants, businesses, Churches, and parks will reopen, but I suspect that people may shy away from crowds for a while. My wife, I’m sure, will continue Cloroxing grocery bags.

Businesses might rethink the idea of traditional offices and telework will probably be more commonplace.

What will the Housing Market look like?

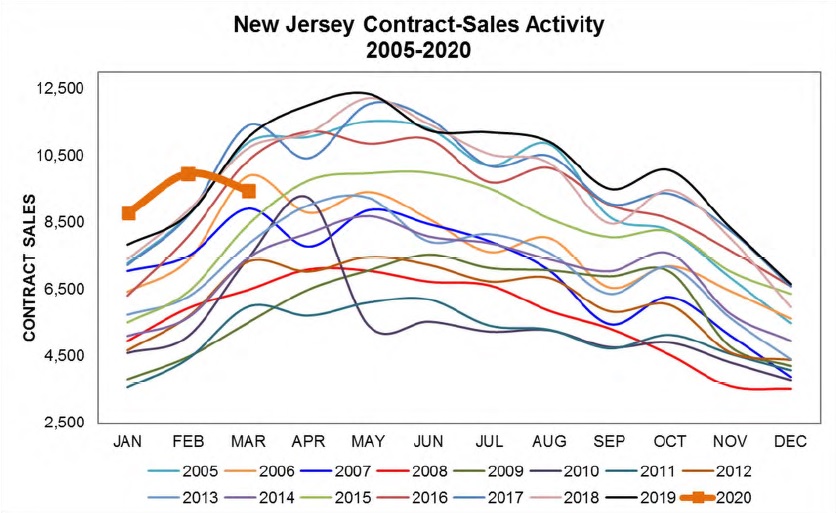

The first 2 months of 2020 saw more homes sold in January and February, 14% more than in January and February of 2019. We don’t have a lot of data to look at yet, but the second half of March saw sales slowing down almost 15% compared to 2019 and almost 30% lower than the prior month.

The first 2 months of 2020 saw more homes sold in January and February, 14% more than in January and February of 2019. We don’t have a lot of data to look at yet, but the second half of March saw sales slowing down almost 15% compared to 2019 and almost 30% lower than the prior month.

The experts are saying that we’re in for a bumpy roller coaster ride.

Predictions for April, with things still in lock-down, are there will be 70-90% fewer homes sold in this month compared to 2019! That is a monumental but not surprising drop. Buyers are reluctant to purchase based on a virtual tour or online photos.

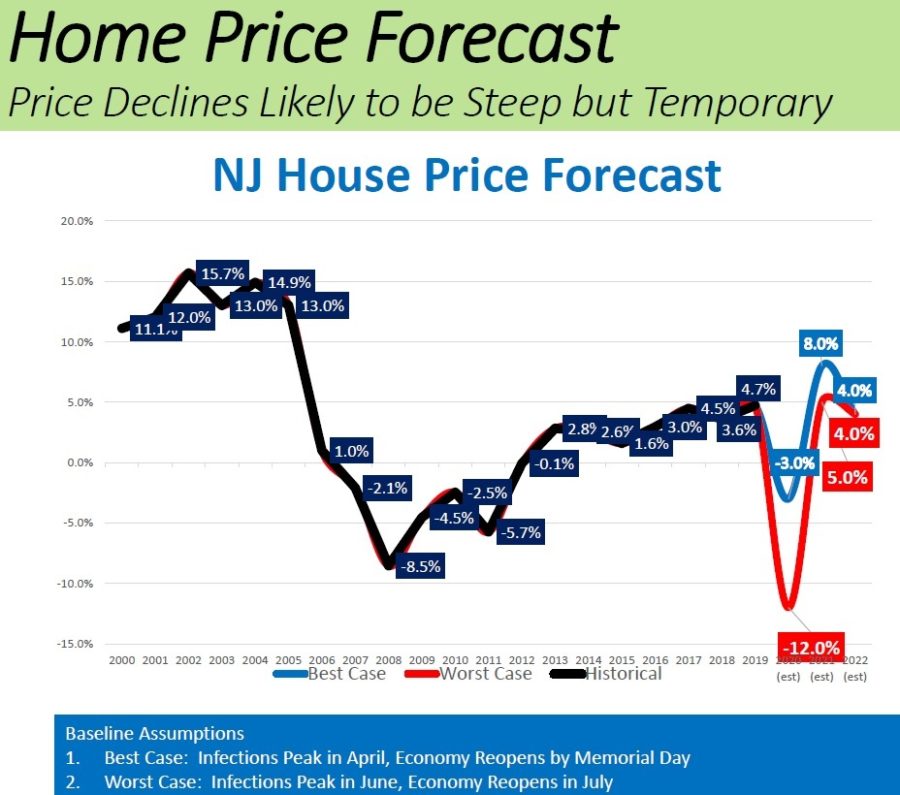

How long will the decline last? A lot depends on the peak in coronavirus infections. If infections peak in April, the economy may open up around Memorial Day. If infections don’t peak until June, however, we may have to wait until early July for business to begin again.

may open up around Memorial Day. If infections don’t peak until June, however, we may have to wait until early July for business to begin again.

Once businesses open again, experts expect that home sales will return to 2019 levels after about 6 weeks – in July and August in the best case scenario.

Then, sales will increase sharply by September with the increase slowing slightly through the end of the year. What we normally think of as the spring market will take place starting in September and continuing through the end of the year.

The worst-case scenario is that April will see a 90% decrease in homes sold. Subsequent months will sales improve slightly, with the year-over-year sales down around 50% in August and around 25% in September. Things will level off in October and match 2019 numbers for the last 3 months of the year. There will not be a 2020 Spring Market based on this scenario.

Home Prices Moving Forward

Regardless of when the peak of infections hit, there will be fewer homes sold this year compared to last year. What will happen to home prices? It’s reasonable to expect that prices are going to drop following a resurgence of a Buyer’s Market for several months or possibly longer.

Regardless of when the peak of infections hit, there will be fewer homes sold this year compared to last year. What will happen to home prices? It’s reasonable to expect that prices are going to drop following a resurgence of a Buyer’s Market for several months or possibly longer.

A Buyer’s Market is when there are more homes offered for sale than are buyers; supply is high and demand is low. In this situation, prices fall to make properties more attractive to buyers.

Depending on unemployment and how well the economy rebounds, we may see more short sales (where the home is worth less than the current mortgage amount) and foreclosures in the upcoming market. This will be more prevalent in the lower end market (below $400,000) than in other markets, but history shows that the lower priced market will recover more quickly.

In the best case scenario, things are back to “normal” in June and the economy is recovering strongly from the coronavirus induced downturn. Unemployment numbers will fall and more people will be working again. In that case, New Jersey will only experience a 3-4% drop in home prices and that drop will last only through the rest of the year. In 2021, we could see prices in NJ rise by as much as 8% and another 4% in 2022. Great news if you purchase a home in the next few months and want to see your equity quickly grow.

If we are dealing with a worst case scenario, in the short term home prices could fall statewide by as much as 12%! But even in the worst case, 2021 will see a 5% rise in prices and 2022 will see 4% growth in price with prices at that time about 3% less than where we were before the coronavirus crisis hit the US.

In either scenario the lower end properties will rebound faster.

Luxury Homes

The luxury market (homes priced at more than $2,000,000) will continue to be in a strong buyer’s market. In some high-end markets if no new homes came on the market it would take more than 2 years to sell off the current inventory.

What should you do?

For the short term, if you don’t NEED to sell, you should stay where you are. You’ll likely make more selling a year or two down the road.

If you sell your home between now and the end of the year, you will be selling it anywhere  between 3% and 12% less than what you could get by waiting. If you need to make a move, be prepared to discount your price. You will likely find that it will take longer than what we’ve been experiencing the last couple of years and you may only get offers significantly lower than you would have gotten three months ago. Even if prices fall 5%, buyer’s offers will likely be 1.5 times the drop in price. So if your home was worth $500,000, it’s now worth $475,000 and buyers will be offering about 7.5% less around $462,500.

between 3% and 12% less than what you could get by waiting. If you need to make a move, be prepared to discount your price. You will likely find that it will take longer than what we’ve been experiencing the last couple of years and you may only get offers significantly lower than you would have gotten three months ago. Even if prices fall 5%, buyer’s offers will likely be 1.5 times the drop in price. So if your home was worth $500,000, it’s now worth $475,000 and buyers will be offering about 7.5% less around $462,500.

If your home is currently on the market, you’ll most likely need to drop your price. Overpriced homes take a long time to sell and when they do they will sell for less than what they would have if the home was priced right when it first went on the market.

We promote a strategy to price your home 3-5% less than current market value. Doing this will result in your home selling quickly and for MORE money as you’re likely to get a bidding war by being the best value for the money on the market.

What if you were looking to buy a home? Well, once you’re able to actually go out and see homes in person again, this is going to be a GREAT time for you.

Mortgage rates

Mortgage rates are at historic lows now and predictions are that they could fall to the low 3’s or even as low as 2.9% for a 30-year fixed mortgage.

Mortgage rates are at historic lows now and predictions are that they could fall to the low 3’s or even as low as 2.9% for a 30-year fixed mortgage.

If you’re looking to buy, now is a GREAT time as interest rates are low and prices will be falling, so you will be able to purchase a bit more home for your money. For every percentage point that interest rates drop, the price you can afford increases by 9%. If interest rates were at 4% and you could afford a $400,000 home, that if rates are at 3% you can now buy a home worth $436,000 and your monthly payment will be the same in both situations.

If you’re looking to buy, now is a GREAT time as interest rates are low and prices will be falling, so you will be able to purchase a bit more home for your money. For every percentage point that interest rates drop, the price you can afford increases by 9%. If interest rates were at 4% and you could afford a $400,000 home, that if rates are at 3% you can now buy a home worth $436,000 and your monthly payment will be the same in both situations.

Questions? Need to know more?

Contact TeamZuhl today and we’ll help you. You can reach us at WayneZuhl.com, TeamZuhl@gmail.com or by phone at 908-917-4189.